|

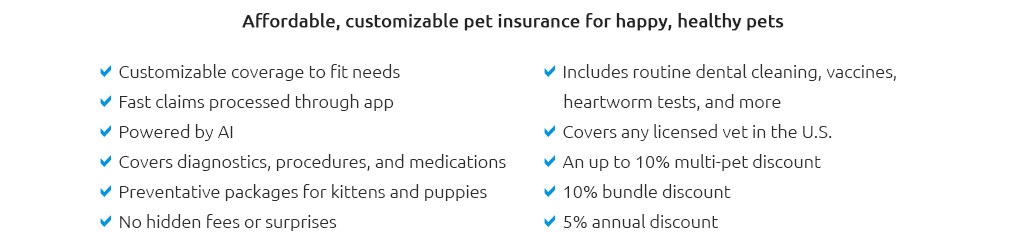

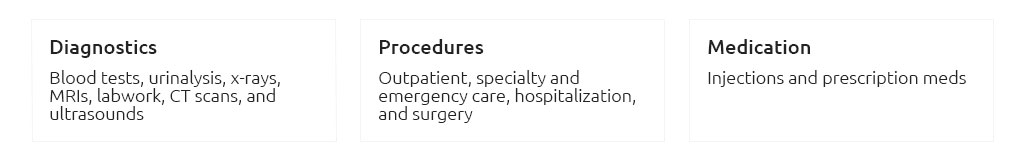

medical insurance for cats and dogs made simple and supportiveWhat it covers vs what it skipsYou want fast clarity. Think in two buckets: care the plan usually pays toward, and care you'll likely handle yourself. That split keeps expectations steady and stress lower. Typically covered- Accidents and emergencies: broken bones, swallowed objects, wound care.

- Illnesses: infections, GI issues, skin conditions, some chronic diseases.

- Diagnostics: X-rays, bloodwork, ultrasound, advanced imaging when needed.

- Surgery, hospitalization, prescription meds, and follow-up visits tied to the claim.

- Hereditary or congenital conditions on many plans, once past waiting periods.

Common gaps- Pre-existing conditions and symptoms noted before enrollment.

- Waiting periods at the start; orthopedic issues may have longer waits.

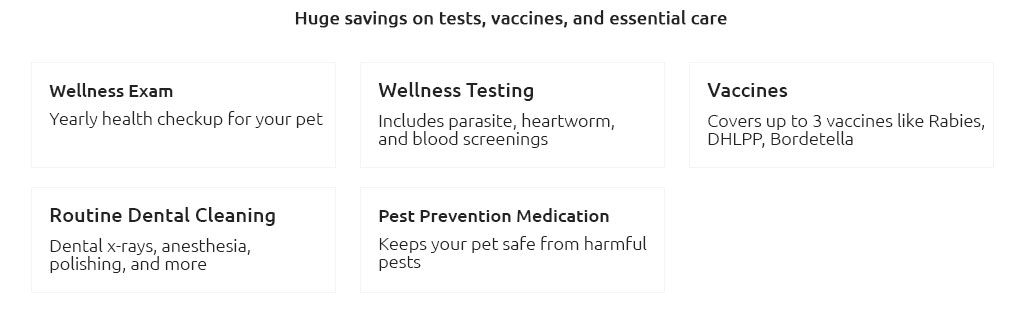

- Routine and dental cleanings unless you add a wellness option.

- Breeding, elective, or cosmetic procedures.

- Policy caps: annual, per-incident, or lifetime limits on some plans.

Pragmatic caveat: premiums typically rise with age and local costs, and no plan covers every scenario. Build a small savings cushion alongside insurance for smooth budgeting. Cats and dogs: similar needs, different rhythmsBoth benefit from protection against big, surprise bills. Yet their risk patterns diverge, which can shape your choice. - Cats: often hide pain; chronic kidney disease and urinary issues are common. Indoor lifestyles can lower accident risk but not medical complexity.

- Dogs: more accident-prone; orthopedic injuries and ingestion mishaps show up more. Large breeds may face higher orthopedic costs.

- Age matters: kittens/puppies trigger fewer exclusions if insured early; seniors may face higher premiums and stricter terms.

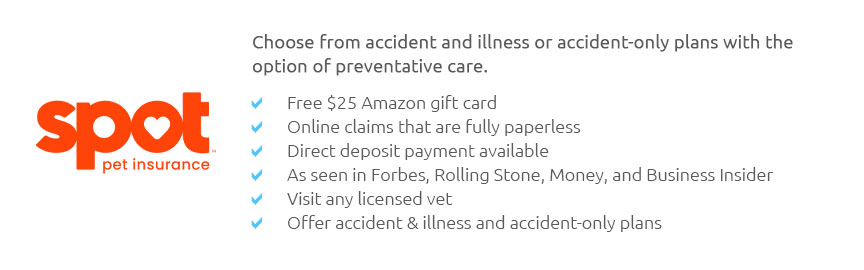

Plan shapes, simplified- Accident-only: lean price, protects against mishaps; not for illness-heavy histories.

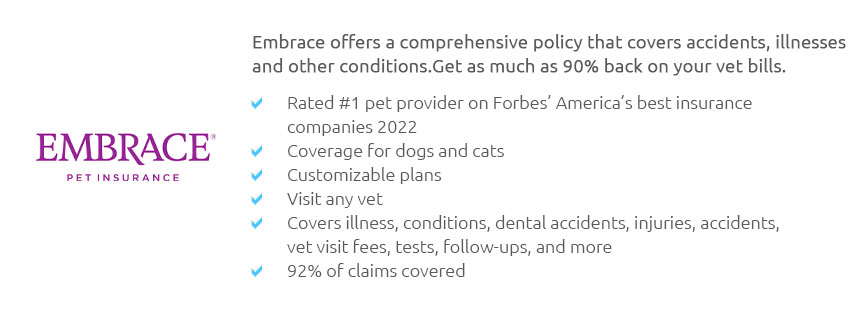

- Accident + illness: the common middle, broad medical events covered.

- Comprehensive with wellness add-ons: includes routine care credits; helpful if you prefer predictable budgeting.

How reimbursement usually works- Visit any licensed vet you trust; focus on care first.

- Pay your invoice, then submit a claim (photo upload or portal).

- After deductible and your chosen reimbursement rate (for example 70 - 90%), funds are sent back to you up to policy limits.

Real-world moment: on a wet Tuesday, Lena's beagle skidded at the park and needed stitches. She sent a photo of the invoice from the clinic parking lot; money landed back in her account a few days later, easing the week's worry. Costs in contextPrice reflects species, breed, age, location, deductible, reimbursement percent, and annual limit. Orthopedic-prone dogs and purebreds may cost more to insure; indoor adult cats often sit lower. Raising your deductible or choosing a lower reimbursement can trim premiums while keeping catastrophe protection. Key words decoded- Deductible: what you pay before coverage helps (per year or per condition).

- Reimbursement %: the share the insurer pays after the deductible.

- Co-pay: your portion after reimbursement (the flip side of the percentage).

- Annual limit: the max the plan pays in a policy year.

- Waiting period: days after start when new claims aren't yet eligible.

- Pre-existing: conditions or signs noted before coverage; generally excluded.

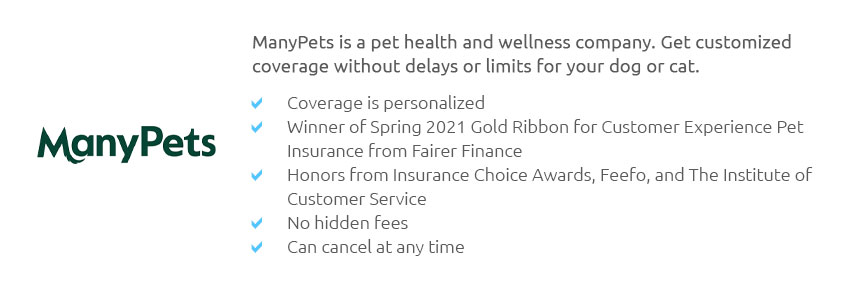

- Chronic/continuous care: confirm that ongoing conditions remain covered each renewal.

Simple paths to a choice- Seeking a safety net on a budget: accident-only or higher deductible accident + illness.

- Balanced peace of mind: accident + illness with mid-range limits.

- Predictable yearly spend: comprehensive plan plus wellness add-on if you like bundling checkups.

What to ask before enrolling- Are orthopedic or dental injuries subject to special waits or caps?

- Is the deductible annual or per-condition, and does it reset?

- How are bilateral issues handled (e.g., both knees)?

- Do chronic conditions carry over without new exclusions at renewal?

- How fast are claims typically paid, and can direct pay be arranged in emergencies?

- Is there a lifetime or per-incident maximum I should plan around?

Support and clarity win. Pick a deductible you could comfortably cover today, keep digital copies of vet records for smoother claims, and skim the sample policy before you commit. The right plan won't replace your veterinarian; it simply stands behind the care you already trust.

|

|